Introduction In today’s world, intelligence is often confused with appearance. Speaking confidently, using complex words, or sharing popular opinions can make someone look smart. But true intelligence is rarely loud. It is built quietly, through habits that strengthen thinking, improve judgment, and deepen understanding over time. Intelligence is not a fixed trait or a gift you are born with—it is a daily practice shaped by what you consume, how you reflect, and how often you challenge your own mind. Most people focus on upgrading external tools—phones, gadgets, credentials—while ignoring the most powerful tool they already have: their mind. Training intelligence does not require extraordinary talent or access to elite institutions. It requires intention, discipline, and consistency. The following habits do not offer instant recognition, but over time they sharpen clarity, improve decision-making, and raise your intellectual capacity in a meaningful and lasting way. Control ...

Introduction

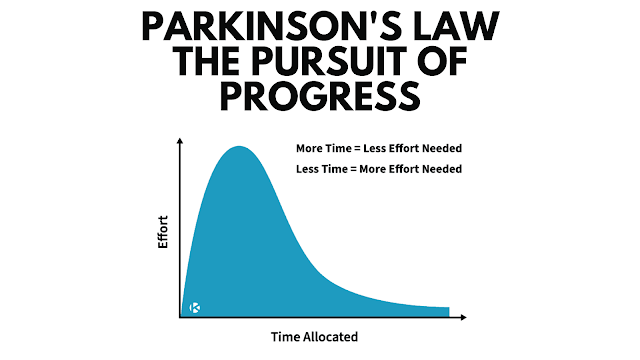

Parkinson's Law is a popular concept that states that expenses tend to expand to meet income levels. The idea behind this theory is that people tend to increase their spending as their income increases, resulting in a never-ending cycle of lifestyle inflation. The Law was first articulated by British historian and author C. Northcote Parkinson in his book, "Parkinson's Law: The Pursuit of Progress."Although Parkinson's Law has existed for many decades, it remains pertinent in contemporary times. The Law states that "expenses expand to meet income level." This means that as our income increases, our expenses also increase, leading to little to no change in our overall financial position. This blog post will cover Parkinson's Law, its correlation with lifestyle inflation, and techniques to overcome it.

Parkinson's Law in Personal Finance

Lifestyle inflation is when individuals increase their spending as their income increases. For example, when you get a raise or promotion at work, you might upgrade your car or take a more expensive vacation. Parkinson's Law influences lifestyle inflation because it is human nature to want more as we have more. The problem with lifestyle inflation is that it can lead to financial instability and create a cycle of dependency on a certain income level. This can be especially problematic if an individual loses their job or experiences a reduced income. They may struggle to maintain their lifestyle, and their savings may not be enough to cover unexpected expenses.The negative impact of lifestyle inflation on personal finance

Lifestyle inflation can be detrimental to personal finance in several ways:It reduces the amount of money that an individual can save. When expenses increase with income, there is little room for savings, which can lead to limited financial flexibility in the future.

It can create debt, as individuals may rely on credit cards or loans to maintain their lifestyles. This can result in high-interest payments and a reduced credit score.

Lifestyle inflation can create a false sense of security, where individuals believe they are financially stable but live paycheck to paycheck.

It is important to set financial goals. It's important to create plans that are SMART, which means they should be specific, measurable, achievable, relevant, and time-bound. By setting goals, individuals can clearly understand what they want to achieve financially and stay motivated to reach their objectives.

It is essential to establish a budget and adhere to it. A budget helps individuals track their income and expenses, identify areas where they can reduce spending, and ensure they are saving enough.

Increasing the savings rate is essential to combat Parkinson's Law.

By increasing savings, individuals can create a financial cushion, providing a sense of security and reducing reliance on a certain income level. Lastly, it is important to avoid the temptation of lifestyle inflation. This can be achieved by being mindful of spending habits, being content with what we have, and avoiding comparing ourselves to others.

Lifestyle inflation can create a false sense of security, where individuals believe they are financially stable but live paycheck to paycheck.

Strategies to Combat Parkinson's Law and Lifestyle Inflation

Individuals can employ various tactics to counteract the effects of Parkinson's Law and lifestyle inflation, including:It is important to set financial goals. It's important to create plans that are SMART, which means they should be specific, measurable, achievable, relevant, and time-bound. By setting goals, individuals can clearly understand what they want to achieve financially and stay motivated to reach their objectives.

It is essential to establish a budget and adhere to it. A budget helps individuals track their income and expenses, identify areas where they can reduce spending, and ensure they are saving enough.

Increasing the savings rate is essential to combat Parkinson's Law.

By increasing savings, individuals can create a financial cushion, providing a sense of security and reducing reliance on a certain income level. Lastly, it is important to avoid the temptation of lifestyle inflation. This can be achieved by being mindful of spending habits, being content with what we have, and avoiding comparing ourselves to others.

Comments

Post a Comment

Please do not add any spam link in the comment box